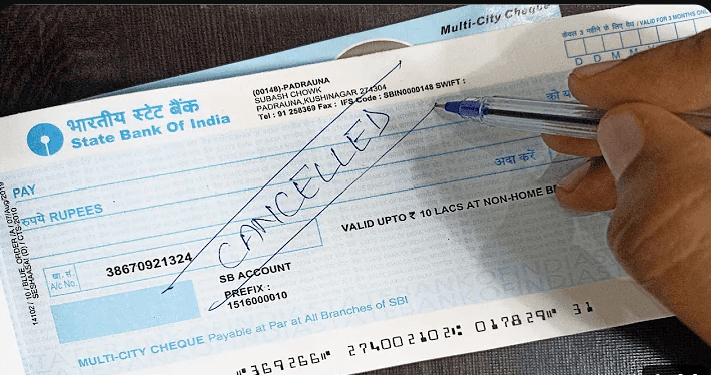

In the world of banking and finance, a cancelled cheque plays a crucial role. It is a cheque that has ‘CANCELLED’ written in caps on it between two parallel lines drawn across the cheque. This article aims to provide a comprehensive understanding of cancelled cheques, their uses, and how to issue them.

What is a Cancelled Cheque?

A cancelled cheque is a cheque that has your bank account number, cheque number, IFSC code, and the MICR (Magnetic Ink Character Recognition) code. It serves as validation of the account holder’s information such as IFSC, MICR, account number, bank branch details, and the account holder’s name. This helps prevent withdrawing funds, although there is a possibility that it may fall into wrong hands and be misused.

How to Write a Cancelled Cheque?

Cancelling a cheque is a simple process. Here are the steps to cancel a cheque:

- Take a leaf from your cheque book.

- Use a blue/black pen and draw two parallel lines across the cheque.

- As you draw the lines, ensure you do not cancel or overlap IFSC, MICR, account holder’s name, bank name and branch, or any other detail.

- Do not fill in other details such as name, amount, or date.

- Do not put your signature.

- Write ‘CANCELLED’ in between the parallel lines.

When is a Cancelled Cheque Required?

A cancelled cheque is required for various financial transactions such as loan applications, insurance policies, and credit card applications. It serves as evidence of the account holder’s name, bank details, and signature. It is also used for providing bank account details to third parties, setting up automatic bill payments, and completing KYC norms.

A cancelled cheque is often required in the following scenarios:

- Mutual Funds: If you are investing in mutual funds or the stock market, you must open a Demat account. The company would want you to submit a cancelled cheque to open the account to verify if the bank account associated with the investment is yours in reality.

- EMI: Equated Monthly Instalments (EMI) is the most sought after method of payment when you are buying a gadget or a high-value item. Individuals pay monthly instalments even in the case of loans such as car loan, home loan, education loan, and personal loan. To initiate the process of monthly instalments, you must submit a cancelled cheque as proof of having a bank account.

- Electronic Clearance Service: An electronic clearance service automatically deducts money from your account every month for any transaction you have done. In this case, you must set up the electronic clearance service.

- Provident Fund Withdrawal: Companies generally ask for a cancelled cheque when you want to withdraw your EPF money.

- Insurance Policy: A cancelled cheque is required even when you are purchasing an insurance policy.

Difference Between Cancelled Cheque and Stop Payment

While both prevent transactions, a cancelled cheque is used as evidence of one’s existing bank account and their financial credibility. A stop payment instruction is issued when there are insufficient funds, if the signed cheque is misplaced, or if there is a suspicion of fraud.

Difference Between Cancelled Cheque and Voided Cheque

A cancelled cheque and a voided Cheque are both types of checks that cannot be used to withdraw money. However, they are used in different contexts and have different implications:

Cancelled Cheque: A cancelled cheque is a cheque that has ‘CANCELLED’ written across it between two parallel lines. It is used to provide proof of an existing bank account and is often required for various financial transactions. Once a cheque is cancelled, it cannot be used to withdraw money.

Voided Cheque: A voided Cheque is a check that has ‘VOID’ written across it. It is used when you need to provide banking information but don’t want the check to be used for a payment. Unlike a cancelled cheque, a voided check is invalidated before it is used for any transaction.

In summary, the main difference between a cancelled cheque and a voided check is that a cancelled cheque is used as proof of an existing bank account and cannot be used to withdraw money, while a voided check is invalidated before it is used for any transaction.

Conclusion

In conclusion, a cancelled cheque is a powerful tool in the banking and finance world. It serves as a proof of one’s bank account and prevents misuse of the cheque. It is essential to understand its uses and how to issue one to ensure smooth financial transactions.

Frequently Asked Questions on Cancelled Cheques

- What is a cancelled cheque?

- A cancelled cheque is a cheque that has ‘CANCELLED’ written across it between two parallel lines. It is used to provide proof of an existing bank account and is often required for various financial transactions.

- How to write a cancelled cheque?

- A cancelled cheque is written by drawing two parallel lines on a sheet of cheque and the word ‘CANCELLED’ written across it.

- Can anyone encash my cancelled cheque?

- No, a cancelled cheque cannot be used to withdraw or transfer funds.

- Do I need to sign a cancelled cheque?

- No, you do not need to sign a cancelled cheque.

- Can I cancel my cheque online?

- The process of cancelling a cheque online varies depending on the bank’s policies.

- Can I use my cancelled cheque again?

- No, once a cheque is cancelled, it cannot be used again.

- Can I use the old cheque book for a cancelled cheque?

- It is generally advisable to use the chequebook which carries your updated bank account information.

- What is the difference between a cancelled cheque and a void cheque?

- A cancelled cheque is used as proof of an existing bank account and cannot be used to withdraw money, while a void cheque is invalidated before it is used for any transaction.

- When would you need a cancelled cheque?

- A cancelled cheque is required when one wants to open a demat account, withdraw from their EPF, make a high-value purchase, complete KYC norms, etc