Affordable housing is a key priority for the Indian government, and the Pradhan Mantri Awas Yojana – Urban 2.0 (PMAY-U 2.0) is a significant step towards achieving this goal. This scheme aims to provide housing for all urban residents, ensuring that every eligible family owns a pucca house. If you’re planning to buy a home, understanding PMAY-U 2.0 can help you benefit from the interest subsidy and affordable housing opportunities.

What is PMAY-U 2.0?

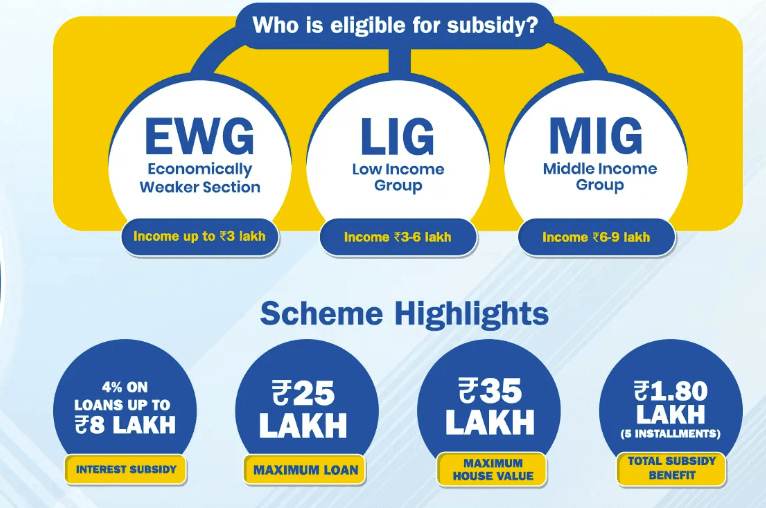

PMAY-U 2.0 is an extension of the original Pradhan Mantri Awas Yojana (Urban), launched in 2015. This scheme aims to provide affordable housing to economically weaker sections (EWS), low-income groups (LIG), and middle-income groups (MIG). The scheme facilitates homeownership through interest subsidies on home loans, making housing more accessible to urban dwellers.

Key Features of PMAY-U 2.0

- Interest Subsidy: Eligible beneficiaries can avail an interest subsidy of up to 4% on home loans up to ₹8 lakh for a tenure of 12 years, reducing the cost of borrowing.

- Target Beneficiaries: Focus on EWS, LIG, and MIG groups who do not own a pucca house.

- Women Empowerment: Preference is given to female property owners, encouraging women’s participation in homeownership.

- Affordable Housing Focus: The scheme promotes affordable housing projects in partnership with private developers.

- Green and Sustainable Homes: Encourages eco-friendly and energy-efficient construction methods.

Eligibility Criteria

To apply for PMAY-U 2.0, you must meet the following criteria:

- Income Groups:

- EWS: Annual household income up to ₹3 lakh.

- LIG: Annual household income between ₹3 lakh and ₹6 lakh.

- MIG: Annual household income between ₹6 lakh and ₹9 lakh.

- Property Ownership: The applicant or their family members must not own a pucca house anywhere in India.

- Aadhaar Requirement: Aadhaar validation is mandatory for application.

- Female Ownership: The property should ideally be registered in a woman’s name, or jointly owned.

How to Apply for PMAY-U 2.0?

Follow these steps to apply for the scheme:

- Check Eligibility: Visit the official PMAY-U portal (https://pmaymis.gov.in) and verify your eligibility.

- Aadhaar Verification: Enter your Aadhaar details for identity verification.

- Fill Out the Application: Provide personal and income details.

- Upload Documents: Submit income proof, bank details, Aadhaar card, and other required documents.

- Loan Application: Approach a registered bank or housing finance company to avail the subsidy-linked home loan.

- Receive Subsidy: Once approved, the subsidy amount will be credited directly to your loan account, reducing your overall EMI burden.

Participating Banks and Financial Institutions

PMAY-U 2.0 loans and subsidies are facilitated through Primary Lending Institutions (PLIs), which include:

- Scheduled Commercial Banks

- Housing Finance Companies (HFCs)

- Regional Rural Banks (RRBs)

- State Cooperative Banks

- Urban Cooperative Banks

- Small Finance Banks (SFBs)

- Non-Banking Financial Company – Micro Finance Institutions (NBFC-MFIs)

- Other financial institutions identified by the Reserve Bank of India (RBI)

Additionally, National Housing Bank (NHB), HUDCO, and the State Bank of India (SBI) act as Central Nodal Agencies (CNAs) for routing the subsidy. The State Level Bankers Committee (SLBC) also monitors the scheme’s implementation. To avail of the subsidy, applicants should apply through an eligible PLI, which processes the loan and disburses the interest subsidy in installments.

Why PMAY-U 2.0 is Important for Homebuyers?

- Lower Home Loan Costs: The interest subsidy significantly reduces EMI payments.

- Boost to Affordable Housing: The scheme promotes affordable housing projects, making homeownership more accessible.

- Encourages First-Time Buyers: The scheme targets those without a pucca house, enabling new buyers to enter the housing market.

Frequently Asked Questions (FAQs)

1. Who is eligible for PMAY-U 2.0?

Any urban resident from the EWS, LIG, or MIG category who does not own a pucca house anywhere in India and meets the income criteria can apply.

2. What is the maximum subsidy available under PMAY-U 2.0?

Eligible beneficiaries can avail of a maximum interest subsidy of ₹1.8 lakh on home loans up to ₹8 lakh for a tenure of 12 years.

3. How can I apply for PMAY-U 2.0?

You can apply through the official PMAY-U portal, submit your Aadhaar details, complete the application form, and approach a registered bank for a subsidy-linked loan.

4. Which banks offer home loans under PMAY-U 2.0?

Loans are provided by Scheduled Commercial Banks, Housing Finance Companies, Regional Rural Banks, State and Urban Cooperative Banks, and other institutions approved by the RBI.

5. Can I sell my house after availing of the PMAY-U 2.0 subsidy?

No, there is a mandatory lock-in period of five years during which the property cannot be sold or transferred.

6. What happens if I already own a house?

If you or any member of your family already owns a pucca house anywhere in India, you are not eligible for PMAY-U 2.0.

7. How will I receive the subsidy?

The subsidy amount will be credited directly to your home loan account, reducing your principal outstanding.

8. What documents are required to apply?

You need Aadhaar details, income proof, bank account details, and property-related documents.

Final Thoughts

PMAY-U 2.0 is a golden opportunity for aspiring homeowners, especially those from EWS, LIG, and MIG categories. If you qualify, applying for this scheme can help you secure an affordable home with lower financial stress. Visit the official website and start your journey towards homeownership today!

For more finance-related insights and updates, stay tuned to Banking Insights!