In today’s fast-paced digital world, banking has become quicker and more convenient. Gone are the days of waiting in long lines or dealing with piles of paperwork to open a savings account. You can now easily open an SBI savings account online from the comfort of your home. In this guide, we’ll walk you through the steps of opening your account, explore its key features, and share tips to ensure a smooth experience.

What is an SBI Savings Account?

An SBI Savings Account offers a safe and secure way to manage your finances. Offered by the State Bank of India (SBI), this account helps individuals save money, earn interest, and access various banking services. When you open your SBI savings account online, you enjoy all the benefits of modern banking without needing to visit a branch.

Why Open an SBI Savings Account Online?

Here’s why you should choose the online method for opening your SBI savings account:

- Convenience: You can open the account anytime, anywhere, without stepping into a bank.

- Paperless Process: Forget about paperwork and physical visits. This process is completely digital.

- 24/7 Access: Manage your account anytime using the YONO app, Internet Banking, or Mobile Banking.

- Easy Fund Transfers: Transfer money using NEFT, IMPS, or UPI effortlessly.

- Secure Transactions: The bank ensures your account is protected with encryption and two-factor authentication.

- No Branch Visit: The Video KYC feature eliminates the need for branch visits, speeding up the process.

Step-by-Step Guide to Opening an SBI Savings Account Online

Here’s how you can easily open your SBI savings account online:

Step 1: Download the YONO SBI App

Start by downloading the YONO SBI App from the Google Play Store or Apple App Store. This app will be your gateway to SBI’s digital banking services.

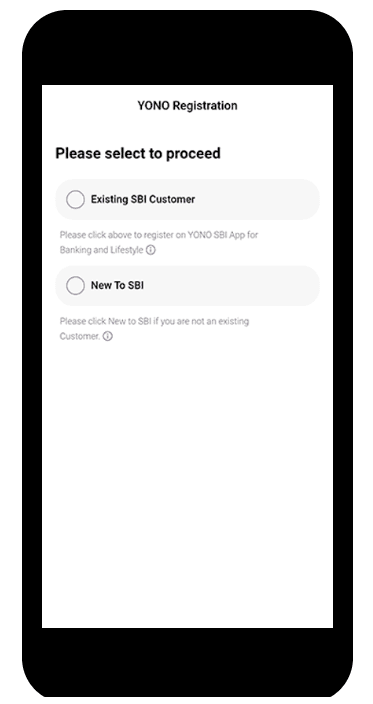

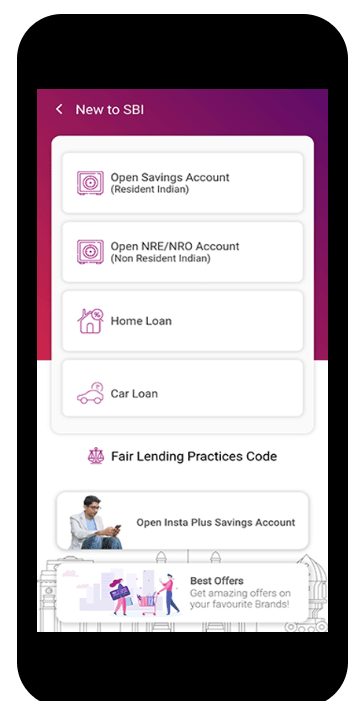

Step 2: Select ‘New to SBI’

After opening the YONO app, find the “New to SBI” button. If you don’t have an existing relationship with SBI, this option allows you to start the account opening process.

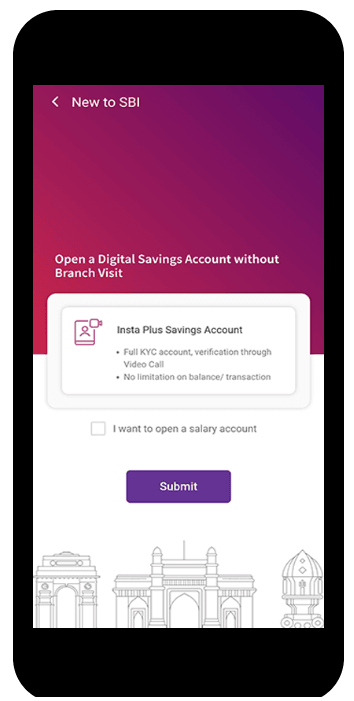

Step 3: Choose ‘Savings Account’

Select the option to open a savings account. Then, choose “Without Branch Visit” to proceed with the online application.

Step 4: Provide Your Details

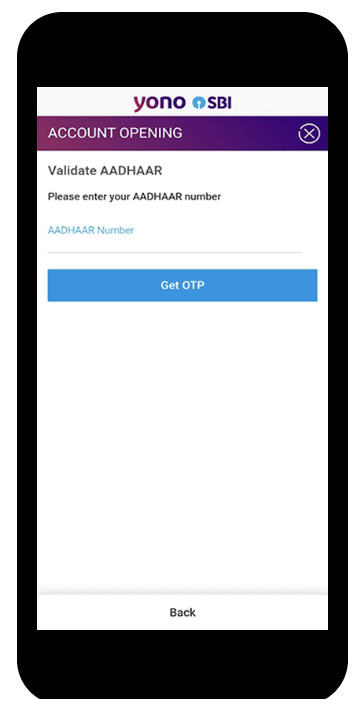

Enter essential details like your Aadhaar number and PAN card number. These details will help verify your identity.

Step 5: OTP Verification

Once you enter your Aadhaar details, you will receive an OTP (One-Time Password) on the mobile number linked to your Aadhaar. Enter the OTP to verify your identity.

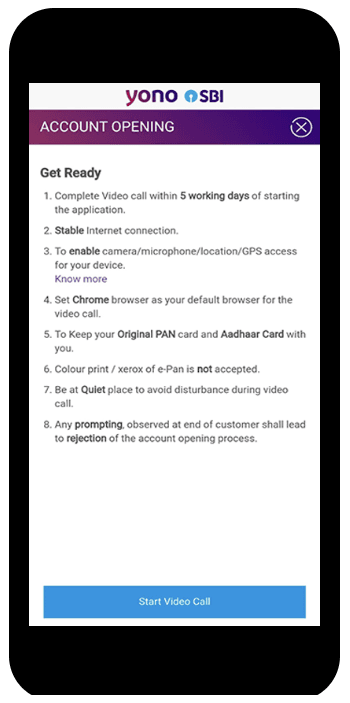

Step 6: Schedule the Video Call

After verification, schedule your Video KYC call. This call will help confirm your identity and verify the details you’ve entered.

Step 7: Complete the Video KYC

At the scheduled time, log into the YONO SBI App and press “Resume” to start the video call. During the call, an SBI representative will ask to see your Aadhaar and PAN card for verification. They will also take a photo to confirm your identity.

Step 8: Account Activation

Once the Video KYC is successfully completed, your SBI savings account will be opened. However, the account will only be activated for debit transactions after the bank’s final verification.

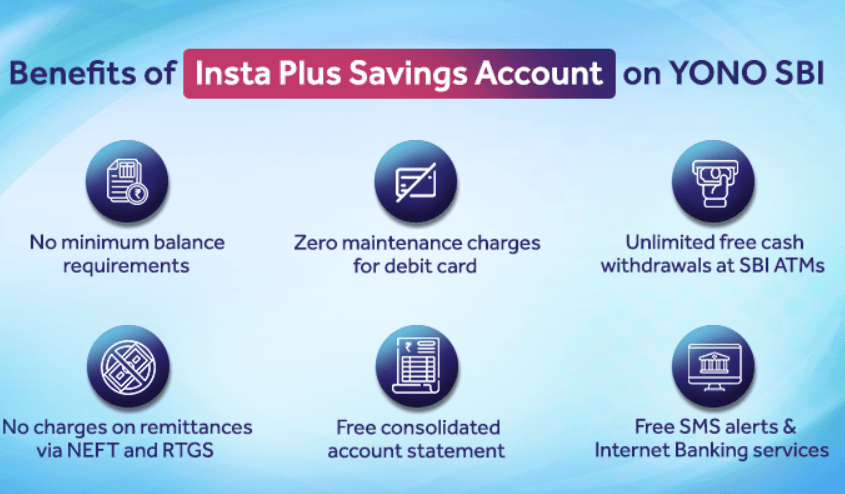

Key Features of an SBI Savings Account

After opening your SBI savings account online, you’ll enjoy several features:

- 24/7 Banking: Access your account anytime through the YONO app, Internet Banking, or Mobile Banking.

- Fund Transfers: Transfer funds easily via NEFT, IMPS, or UPI.

- Rupay Classic Card: Receive a Rupay Classic Card for easy access to your account.

- Nomination Facility: You can nominate someone to manage your account if needed.

- SMS Alerts: Get instant updates on your account activities via SMS.

- Cheque Book & Passbook: Apply for a cheque book or passbook after your account is set up.

Eligibility Criteria for SBI Savings Account Online

Ensure you meet the following criteria before applying for an SBI savings account online:

- You must be a resident Indian aged 18 or older.

- You should have a valid Aadhaar number and PAN card.

- You must not have an existing CIF (Customer Information File) with SBI if you’re opening a new account online.

Frequently Asked Questions

1. Can I open an SBI savings account online without visiting a branch?

Yes, you can open an SBI savings account completely online through the YONO SBI app using the Video KYC process. No branch visit is required.

2. What documents are needed to open the SBI savings account online?

You need your original PAN card, Aadhaar number (with current address), and a mobile number linked to Aadhaar to complete the process.

3. How long does it take to open the SBI account online?

The account can be opened and activated within a few hours or days after successful Video KYC and final verification by bank officials.

4. Will I receive a cheque book and passbook?

Yes, once the account is opened, you can request a cheque book and passbook through YONO, Internet Banking, or by visiting the branch.

5. Can I nominate someone while opening the account?

Yes, nomination is mandatory and can be done online during the account opening process through the YONO app.

6. Is the YONO SBI app available on tablets?

Yes, the app works on tablets that have a SIM card, a unique IMEI number, and a supported operating system.

Open Your SBI Savings Account Online Today!

Opening an SBI savings account online is an easy, secure, and convenient way to manage your money. By following the simple steps in this guide, you can quickly open your account and begin enjoying modern banking. Thanks to features like YONO App, Video KYC, and 24/7 banking, managing your finances has never been simpler. Don’t wait—open your SBI savings account online today and experience the future of banking.