Paying income tax in India is now quicker and easier than ever, thanks to the Income Tax Department’s e-Pay Tax portal. Whether you’re a salaried employee, freelancer, business owner, or taxpayer, you can now pay advance tax, TDS, self-assessment tax, and more—without needing a CA or logging in!

This guide covers everything you need to know about the e-Pay Tax portal, including step-by-step payment instructions, benefits, and FAQs.

What is the e-Pay Tax Portal?

The e-Pay Tax portal is an online tax payment system launched by the Income Tax Department of India. It allows taxpayers to:

✅ Pay taxes directly without logging into the e-filing portal.

✅ Avoid third-party assistance (CAs, tax consultants).

✅ Choose multiple payment modes (UPI, net banking, debit/credit cards).

✅ Get instant receipts (Challan ITNS 280).

💡 No Login Needed! Just enter your PAN & mobile number to pay taxes instantly.

Key Benefits of Using e-Pay Tax Portal

✔ No login required – Pay taxes directly.

✔ 24×7 availability – Pay anytime, anywhere.

✔ Multiple payment options – UPI, net banking, cards, RTGS/NEFT.

✔ Instant challan receipt – Download Challan Identification Number (CIN) immediately.

✔ Supports all tax types – Advance tax, TDS, self-assessment, penalties, etc.

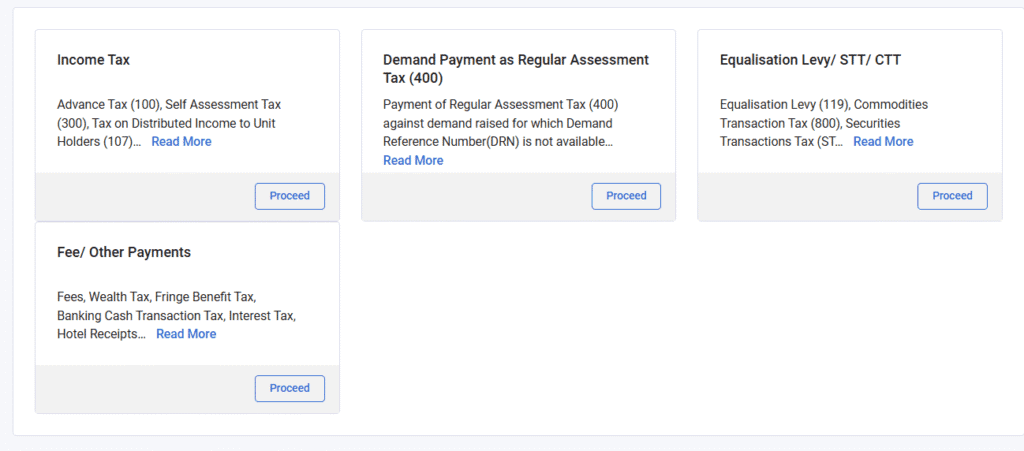

Types of Taxes You Can Pay via e-Pay Tax

| Tax Type | Who Should Pay? |

|---|---|

| Advance Tax | Freelancers, businesses, professionals |

| Self-Assessment Tax | If extra tax is due after TDS deduction |

| Regular Assessment Tax | Payable after income tax notice |

| TDS/TCS | Employers, businesses deducting tax |

| Equalization Levy | E-commerce & digital service providers |

| Interest/Penalty | Late payment charges |

Step-by-Step Guide to Paying Tax Online

Step 1: Visit the e-Pay Tax Portal

Go to https://www.incometax.gov.in → Click “e-Pay Tax” under Quick Links.

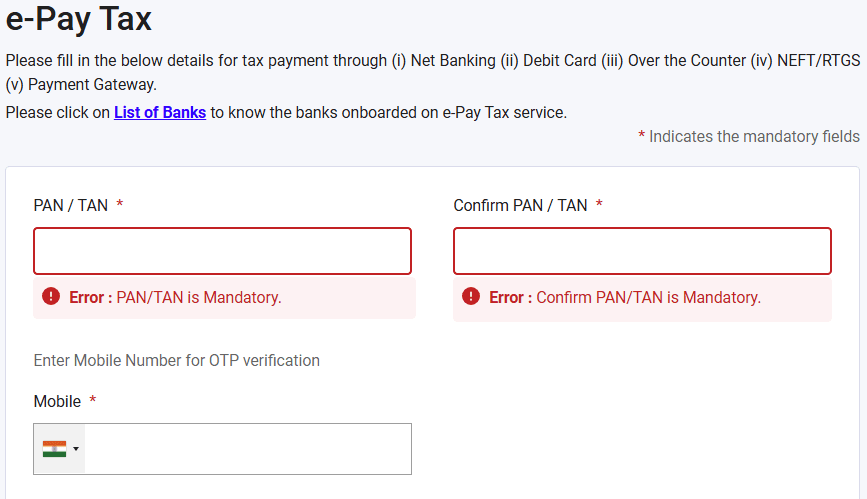

Step 2: Enter PAN & Mobile Number

- Provide your PAN and registered mobile number.

- Verify via OTP.

Step 3: Select Tax Type

Choose from:

- Advance Tax

- Self-Assessment Tax

- TDS/TCS

- Regular Assessment Tax

Step 4: Fill Payment Details

Enter:

- Assessment Year (e.g., 2024-25 for FY 2023-24)

- Tax Amount

- Address (optional)

Step 5: Choose Payment Mode

- Net Banking (SBI, HDFC, ICICI, etc.)

- Debit/Credit Card (Visa, Mastercard, RuPay)

- UPI (PhonePe, Google Pay, BHIM)

- RTGS/NEFT (Bank transfer)

- Offline Challan (Pay via bank branch)

Step 6: Complete Payment & Download Challan

- After payment, Challan ITNS 280 will be generated.

- Save/print the receipt for future reference.

Important Notes

- Cash payments are limited to ₹10,000 per challan.

- Challan validity: 15 days (for offline bank payments).

- TDS/TCS payments require TAN details (if applicable).

- Late payments attract 1% monthly interest under Section 234A/B/C.

Need Help? Contact Income Tax Department

- Helpline: 1800 103 0025 / 1800 419 0025

- Timings: Mon-Sat (9 AM – 8 PM)

- Email: efilingwebmanager@incometax.gov.in

Final Thoughts

The e-Pay Tax portal has revolutionized tax payments in India—making them faster, paperless, and hassle-free. No more long bank queues or dependency on CAs!

Have you used the e-Pay Tax portal? Share your experience in the comments!

🔗 Useful Links:

Stay updated with the latest tax tips & financial guides on [Your Blog Name]. Subscribe for more! 🚀

Pro Tip:

Bookmark https://www.incometax.gov.in for quick tax payments!