When it comes to premium travel credit cards, Chase Sapphire Reserve Credit Card and Chase Sapphire Preferred often top the list. These cards, under the renowned Chase Sapphire branding, offer impressive rewards, valuable perks, and access to some of the best travel benefits available. But which one is right for you in 2025?

With the recent changes to Chase Sapphire Reserve—including a significant increase in its annual fee—many consumers are revisiting their options. In this guide, we’ll break down everything you need to know: rewards, benefits, fees, sign-up bonuses, and long-term value.

Overview of the Chase Sapphire Credit Cards

Before diving deep, let’s quickly introduce both cards.

Chase Sapphire Preferred

- Annual Fee: $95

- Sign-Up Bonus: 75,000 points (after spending $4,000 in 3 months)

- Redemption Boost: Points worth 1.25¢ each on Chase Travel

- Best For: Occasional travelers, everyday spenders

Chase Sapphire Reserve Credit Card

- Annual Fee: $795 (as of June 2025)

- Sign-Up Bonus: 60,000 points (after spending $4,000 in 3 months)

- Redemption Boost: Points can be worth up to 2¢ with new “Points Boost”

- Best For: Frequent travelers, luxury seekers, high spenders

Side-by-Side Comparison (2025)

| Feature | Chase Sapphire Preferred | Chase Sapphire Reserve Credit Card |

|---|---|---|

| Annual Fee | $95 | $795 |

| Travel Credit | $50 hotel credit | $300 travel + $500 hotel |

| Dining Credit | None | $300 via Exclusive Tables |

| Event Credit | None | $300 StubHub/Viagogo |

| Apple Services Credit | None | $250 (Apple TV+, Music) |

| Peloton Credit | None | $120 |

| TSA PreCheck/Global Entry | No | Yes ($100 every 4 years) |

| Lounge Access | No | Yes (Priority Pass + Chase Lounges) |

| Travel Insurance | Limited | Extensive |

| Redemption Value per Point | 1.25¢ (Chase Travel) | 1¢–2¢ (via Boost) |

| Rewards on Travel | 5x via Chase | 8x via Chase, 4x direct |

| Rewards on Dining | 3x | 3x–10x |

Why This Comparison Matters

If you’re like me—a frequent traveler with a flexible budget—you want to maximize every dollar you spend. I’ve carried both cards at different points and can say confidently: your choice should depend on your travel frequency, budget flexibility, and how easily you can redeem rewards and perks.

Chase Sapphire Reserve Annual Fee: Is It Worth It?

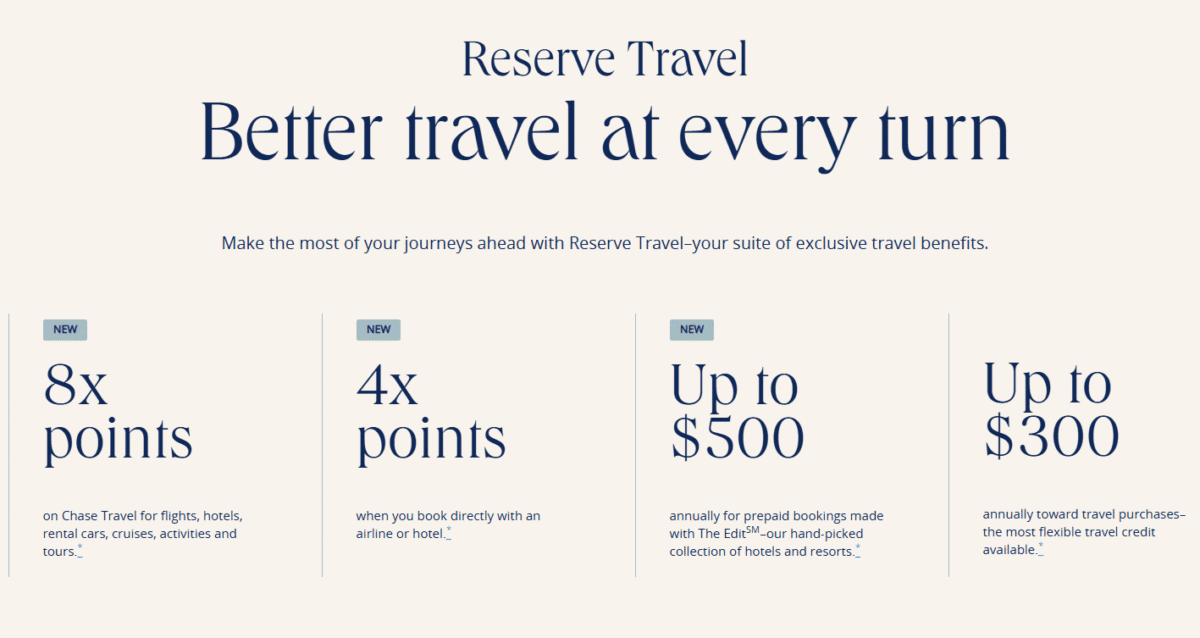

In 2025, the Chase Sapphire Reserve credit card annual fee increased to $795. That’s a $245 hike from its previous $550. Chase justifies this fee with added perks worth up to $2,700, including:

- $300 travel credit

- $500 hotel credit (“The Edit” portal)

- $300 dining via Chase Exclusive Tables

- $300 event ticket credits

- $250 in Apple Music/TV+ subscriptions

- $120 Peloton credit

- TSA PreCheck, IHG elite status, lounge access, travel protections

I travel 4–6 times a year. Between flights, hotels, and Priority Pass lounges, the $795 pays for itself in my case. But for casual users, these credits can go unused.

Tip: If you can’t use at least $600 of these perks annually, go with Chase Sapphire Preferred.

Travel Benefits Compared

Chase Sapphire Reserve:

- 8x points on Chase Travel bookings

- 4x points on direct bookings

- 1x point on other travel

- Access to Points Boost, where points can be redeemed at up to 2¢ each

- Lounge Access (including Chase Sapphire Lounge by The Club)

- Luxury hotel program through The Edit

Chase Sapphire Preferred:

- 5x points on Chase Travel bookings

- 2x points on direct travel

- No lounge access

- Lower redemption value (1.25¢ per point on Chase Travel)

Verdict: If you travel frequently, Chase Sapphire Reserve wins hands down. For occasional trips, Preferred is sufficient and more budget-friendly.

Dining and Daily Rewards

Chase Sapphire Reserve:

- 3x points on all dining

- 10x points on Chase Dining via Chase Travel

- $300 dining credit through Chase’s Exclusive Tables

Chase Sapphire Preferred:

- 3x points on dining

- No dining credits

If you dine out often in cities like NYC, LA, or Chicago—where Exclusive Tables are available—the Reserve card can deliver significant value.

New in 2025: StubHub and Apple Credits

One of the biggest changes in the Chase Sapphire Reserve for 2025 is the addition of lifestyle credits.

- $300 for StubHub/Viagogo: Two $150 semi-annual credits for concerts, sports, and events

- $250 for Apple TV+ and Music: Reimbursement for subscriptions

As someone who attends live events often, I’ve found the StubHub credits highly valuable. The Apple credit is great if you already subscribe or use Apple One.

Peloton and Fitness Benefits

While not as comprehensive as Amex Platinum’s fitness offerings, Reserve’s $120 Peloton credit works well for users who own Peloton gear or use the app. It’s a nice bonus if you’re already invested in the brand.

Hotel Loyalty and Elite Status

The Chase Sapphire Reserve now includes IHG Platinum Elite status—a solid mid-tier hotel loyalty tier. This gets you room upgrades, late check-out, and bonus points.

Paired with the $500 Edit hotel credit, this elevates Reserve’s travel value even more.

Redemption & Transfer Partners

Both cards allow you to transfer points 1:1 to partners like:

- United Airlines

- Singapore Airlines

- Hyatt

- British Airways

- Marriott

The Reserve, however, now includes Points Boost, letting you redeem at up to 2¢/point for select bookings.

This is a game-changer if you know how to hunt for Boost deals.

Business Version Available

In June 2025, Chase launched the Sapphire Reserve for Business with the same perks and the $795 fee. If you’re a freelancer or entrepreneur (like I am), you can maximize perks on business trips while separating expenses.

How to Calculate ROI

Let’s say you redeem the following annually:

| Perk | Value |

|---|---|

| Travel Credit | $300 |

| Hotel Credit | $500 |

| Dining Credit | $300 |

| Event Credit (StubHub) | $200 |

| Apple Services | $250 |

| Peloton | $100 |

| IHG Perks + Lounge Access | $300 |

That’s $1,950 in value for a $795 fee—a net gain of $1,155.

But if you don’t use these perks, the Preferred is the better deal.

My Personal Experience: Why I Chose Sapphire Reserve

I started with Chase Sapphire Preferred during grad school. It gave me:

- A solid 3x return on dining

- The 75,000-point sign-up bonus

- 1.25¢ redemption value

As my income and travel increased, I upgraded to the Chase Sapphire Reserve. Lounge access alone (especially with Priority Pass) paid off when flying long-haul. Add in the hotel credits and redemption boost, and it became a no-brainer.

Signup Bonus Strategy

- Chase Sapphire Preferred gives 75,000 points (worth ~$937.50) for $4,000 spend

- Chase Sapphire Reserve offers 60,000 points (worth up to $1,200 via Boost)

One Chase Sapphire bonus every 48 months — so choose wisely!

Strategy: Apply for Preferred first, then upgrade to Reserve later after 12+ months if needed.

Which Card Is Right for You?

Choose Chase Sapphire Preferred if:

- You want a low annual fee

- You’re a light traveler

- You want to earn points for everyday spend

- You prefer simplicity

Choose Chase Sapphire Reserve if:

- You’re a frequent traveler

- You can use $600+ in annual credits

- You want premium perks and lounge access

- You value 2¢ point redemptions

Final Verdict: Sapphire Preferred vs. Reserve in 2025

| Category | Winner |

|---|---|

| Annual Fee Value | Preferred |

| Travel Perks | Reserve |

| Dining Benefits | Reserve |

| Redemption Value | Reserve |

| Simplicity | Preferred |

| Best Overall | Depends on use |

Pro Tip: Use Both

With Chase now allowing you to hold both Sapphire cards, you can:

- Earn bonuses from one

- Upgrade/downgrade based on usage year-to-year

- Use Reserve for travel, Preferred for everyday spend

Conclusion

Both Chase Sapphire Reserve and Chase Sapphire Preferred are powerful tools in the right hands. Your decision should be based on your travel frequency, spending habits, and ability to leverage perks.

If you’re a frequent traveler who values premium experiences, Reserve is worth every penny. But if you’re budget-conscious or just beginning to explore rewards, Preferred offers unbeatable value for a low fee.

Still unsure? Let me help you with a personalized rewards plan or a calculator based on your spending. Just drop a comment or connect with me on my blog.

Frequently Asked Questions

The annual fee for the Chase Sapphire Reserve credit card is $795 as of 2025, reflecting recent updates and added benefits.

Chase Sapphire Preferred has a lower annual fee ($95) and offers great value for occasional travelers. Sapphire Reserve, with more perks and a higher fee, is ideal for frequent travelers seeking premium experiences.

No, Chase’s 5/24 rule and one-Sapphire-card-at-a-time rule still apply. However, you can upgrade or downgrade between the two if eligible.

You get up to $2,700 in value including a $300 travel credit, $500 hotel credit, $300 dining credit, $300 event credit, $250 Apple credit, and more.

No, only Chase Sapphire Reserve offers airport lounge access via Priority Pass and Chase Sapphire Lounges.

Chase Sapphire Reserve offers superior travel insurance benefits, including trip cancellation, baggage delay, rental car coverage, and more.

Yes, you can request an upgrade after holding the card for at least 12 months. Call Chase customer service to check your eligibility.