A good credit score is essential for securing loans, credit cards, and even better interest rates. If your CIBIL score is low, don’t worry—you can improve it with the right strategies. In this guide, we’ll explain how to improve your credit score with practical steps that work.

Understanding Your Credit Score

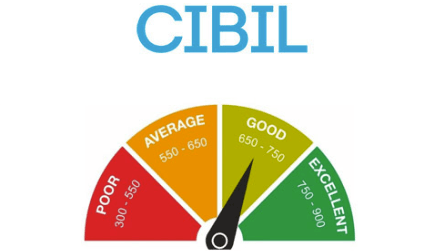

A credit score (CIBIL score in India) is a three-digit number ranging from 300 to 900, which represents your creditworthiness. A higher score means better financial health and easier loan approvals. Most lenders prefer a score above 750 for approving loans at lower interest rates.

Top 10 Ways to Improve Credit Score

1. Check Your Credit Report Regularly

Mistakes in your credit report can lower your score. Download your CIBIL report from the official website and check for errors. If you find incorrect details, report them immediately to CIBIL to get them corrected.

2. Pay Your Bills on Time

Your payment history accounts for 35% of your credit score. Late payments negatively affect your score. Set up auto-pay or reminders to ensure timely payments of:

- Credit card bills

- Loan EMIs

- Utility bills (in some cases)

3. Reduce Your Credit Utilization Ratio

Your credit utilization ratio (CUR) should ideally be below 30%. If your credit limit is ₹1,00,000, try to keep your usage below ₹30,000. High credit utilization signals financial stress and lowers your score.

4. Keep Old Credit Accounts Open

Closing old credit cards reduces your credit history length, which can lower your score. Instead, keep them active with minimal usage.

5. Avoid Multiple Loan Applications

Each loan or credit card application results in a hard inquiry on your credit report. Too many inquiries within a short time can negatively impact your score. Apply for credit only when necessary.

6. Maintain a Healthy Credit Mix

A good credit profile includes a mix of secured loans (home, car loan) and unsecured loans (personal loans, credit cards). Lenders prefer individuals with a well-balanced credit portfolio.

7. Convert Credit Card Dues into EMIs

If you have a high outstanding balance, consider converting it into EMIs instead of missing payments. This prevents a negative impact on your credit score.

8. Pay Off Outstanding Dues

Unpaid dues can lower your score. If you have settled a loan instead of closing it, your credit report may still show a negative impact. Try to pay off old dues completely.

9. Avoid Frequent Balance Transfers

Transferring balances between credit cards frequently may indicate financial instability. Instead, focus on clearing your dues in full.

10. Use Credit Wisely and Responsibly

Avoid unnecessary loans and credit card spending. Responsible usage and regular payments help build a strong credit profile.

How Long Does It Take to Improve Credit Score?

Improving your credit score is a gradual process. If you follow these steps consistently, you can see improvement in 3 to 6 months. However, significant improvement may take 6 to 12 months depending on your financial habits.

Final Thoughts

Boosting your credit score requires discipline and patience. By making timely payments, keeping your credit utilization low, and maintaining a healthy credit mix, you can achieve a 750+ CIBIL score and enjoy better financial opportunities.

Want to check your latest CIBIL score for free? Visit the official CIBIL website and get your report today.

FAQs on How to Improve Your Credit Score

Q1. How often should I check my credit score?

A: At least once every 3 months to monitor changes and detect errors.

Q2. Does checking my own CIBIL score reduce it?

A: No, checking your own credit score is a soft inquiry and does not affect your score.

Q3. Can I improve my score within a month?

A: Small improvements may happen in a month, but major changes usually take 3 to 6 months.

Q4. What is the fastest way to improve my CIBIL score?

A: Paying off outstanding dues and reducing your credit utilization are the quickest ways.

By following these steps, you’ll be on your way to a higher credit score and better financial stability. Start today!

Pingback: Personal Loan vs. Credit Card Loan – Which Is Better? - Banking Insights