A cancelled cheque may seem insignificant, but it plays a critical role in many financial and legal transactions. When you apply for a loan, set up an ECS mandate, or complete KYC formalities, institutions often ask for one. But what does a cancelled cheque do, and how should you write it?

This guide explains everything about cancelled cheques—what they are, why you need them, how to write one, and what precautions to take to avoid misuse.

What is a Cancelled Cheque?

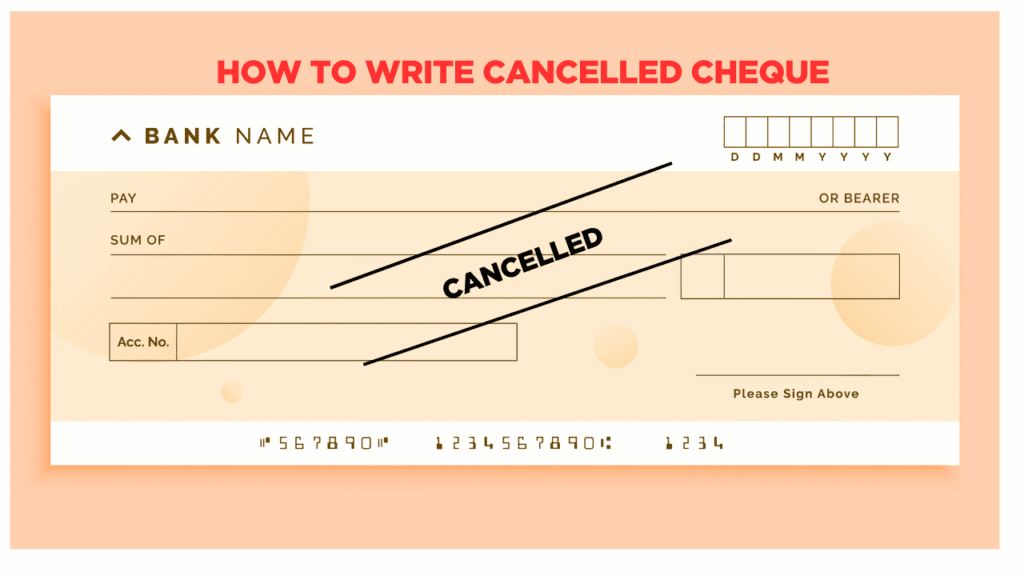

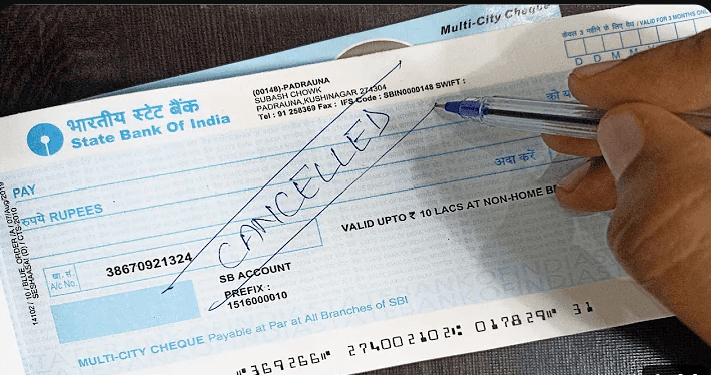

A cancelled cheque refers to a cheque with two diagonal lines across it and the word “CANCELLED” written in between. It doesn’t serve as a payment instrument but helps verify your banking information.

When you submit a cancelled cheque, the receiving party can view:

- Your name (if pre-printed)

- Your bank name and branch

- Your account number

- The IFSC code

- The MICR code

These printed details help confirm your bank account information without the risk of unauthorized transactions.

Why Do You Need a Cancelled Cheque?

Many banks, companies, and financial institutions ask for a cancelled cheque to validate your account details. Here are some common situations where you need one:

- Opening a bank account – Banks use it to confirm your account information.

- Applying for a loan – Lenders use it to disburse funds to your correct account.

- Completing KYC formalities – Financial companies request it for verification.

- Setting up an ECS mandate or EMI – It allows auto-debit instructions from your account.

- Getting your salary credited – Employers use it to ensure accurate salary payments.

- Investing in mutual funds or insurance – Companies verify your account before initiating auto-debits.

- Receiving tax refunds – Income Tax departments use it to validate refund accounts.

How to Write a Cancelled Cheque

Writing a cancelled cheque is easy if you follow the right steps:

Step-by-Step Instructions:

- Choose a fresh cheque – Tear out a new, unused cheque from your cheque book.

- Draw two parallel diagonal lines – Use a pen to mark the lines from one corner to the opposite.

- Write “CANCELLED” clearly – Write it in bold capital letters between the lines.

- Avoid signing the cheque – Most institutions don’t require your signature.

- Leave the other fields blank – Don’t fill in the date, payee name, or amount.

💡 Pro Tip: Use a permanent black or blue pen so no one can erase or modify the cheque.

Precautions When Submitting a Cancelled Cheque

To protect yourself from misuse, keep these precautions in mind:

- Don’t sign it unless requested – Signing it unnecessarily increases the risk.

- Use non-erasable ink – Always use permanent ink to cancel the cheque.

- Draw clear lines and write boldly – Make the cancellation obvious and tamper-proof.

- Submit only to trusted institutions – Hand it over only when a legitimate process demands it.

Do You Need to Sign a Cancelled Cheque?

Most of the time, you don’t need to sign a cancelled cheque. The cheque is not a payment tool, so banks and institutions won’t process it like a regular cheque. However, if a specific lender or company insists on a signature, make sure you understand why and confirm their credibility before signing.

Cancelled Cheque vs. Blank Cheque

Many people confuse cancelled cheques with blank cheques. Here’s the difference:

| Feature | Cancelled Cheque | Blank Cheque |

|---|---|---|

| Diagonal Lines | Yes | No |

| “CANCELLED” Marked | Yes | No |

| Signature Required | No | Usually yes |

| Can Be Cashed | No | Yes, if details are filled |

| Used For | Verification | Rarely used due to risk |

Sample Cancelled cheque

Final Thoughts

A cancelled cheque gives your bank account details in a secure, verifiable way without enabling anyone to withdraw money. When you need to verify your account for loans, ECS mandates, or KYC processes, a cancelled cheque does the job.

Use it carefully, follow the steps correctly, and submit it only when necessary. This simple practice protects your financial information and ensures smooth transactions.

Frequently Asked Questions (FAQs) About Cancelled Cheque

1. What is a cancelled cheque?

A cancelled cheque is a cheque with two parallel lines drawn across it and the word “CANCELLED” written between them. It’s used to verify your bank account details without allowing any monetary transaction.

2. Why do companies ask for a cancelled cheque?

Companies request cancelled cheques to confirm your account number, IFSC code, and bank details for purposes like KYC, ECS, loan disbursement, or salary processing.

3. Do I need to sign a cancelled cheque?

No, you don’t need to sign a cancelled cheque unless a specific institution requests it. In most cases, the signature is not required.

4. Can someone misuse my cancelled cheque?

If you don’t sign or fill out any other details on the cheque, the risk of misuse is extremely low. Just make sure the “CANCELLED” marking is bold and clear.

5. Is a cancelled cheque mandatory for KYC?

Yes, in many cases, banks and financial institutions require a cancelled cheque to verify the account for KYC compliance.

6. Can I use a photocopy of a cancelled cheque?

Generally, financial institutions ask for the original cancelled cheque. Some online services may accept scanned copies, but it’s best to confirm with the concerned authority.

7. How many times can I use a cancelled cheque?

You can use a new cancelled cheque each time it’s requested. Avoid using the same cheque repeatedly to ensure safety and authenticity.

8. What if my name isn’t printed on the cheque?

Some institutions may not accept a cancelled cheque if your name isn’t printed. In such cases, you may be asked to provide a bank statement or passbook copy as additional proof.

Related Searches

- Cancelled cheque sample

- How to write a cancelled cheque

- Cancelled cheque for KYC

- Cancelled cheque image

- Cancelled cheque meaning in banking