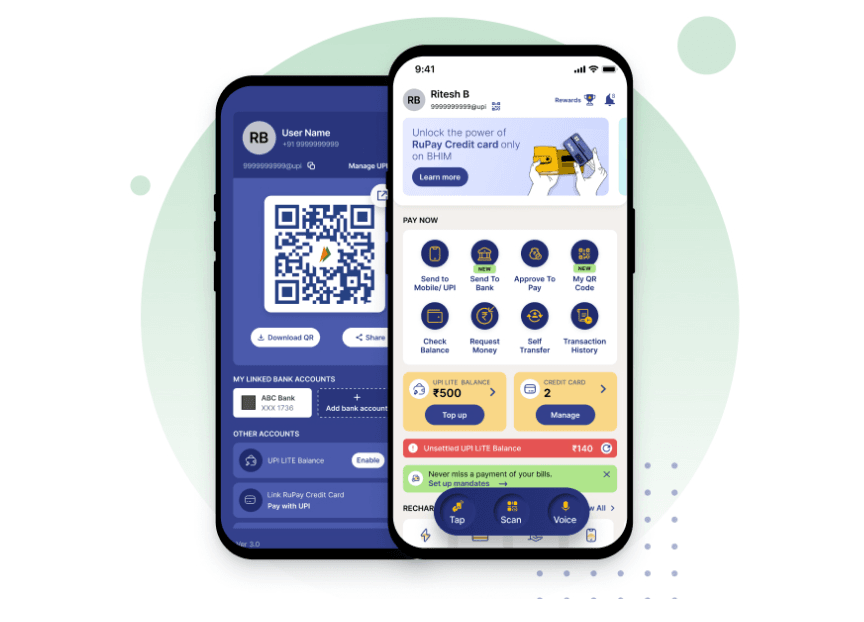

Unified Payments Interface (UPI) has revolutionized digital transactions in India, and with the launch of BHIM-UPI 3.0, the ecosystem has been further enhanced with new features aimed at improving user experience and expanding financial inclusion. Let’s explore what BHIM-UPI 3.0 brings to the table and how it impacts digital payments in India.

What is BHIM-UPI 3.0?

BHIM-UPI 3.0 is an upgraded version of the Bharat Interface for Money (BHIM) app, introduced by the National Payments Corporation of India (NPCI). This update introduces several new functionalities designed to improve the efficiency, security, and accessibility of digital payments in the country.

Key Features of BHIM UPI 3.0

- Overdraft Account Linking

Previously, UPI transactions were limited to savings and current accounts. With BHIM-UPI 3.0, users can now link their overdraft accounts, allowing them to make payments even when their primary bank balance is low. - One-Time Mandate

This feature allows users to pre-authorize transactions, ensuring that funds are debited on a scheduled date. It is particularly useful for IPO applications, subscription services, and other future-dated payments. - Invoice in the Inbox

Before making a payment, users receive an invoice from the merchant within the app. This enhances transparency and ensures that users can verify payment details before proceeding. - Dynamic QR Code for Merchants

Merchants can now generate dynamic QR codes for seamless transactions. This feature is especially beneficial for small businesses, making cashless transactions more secure and efficient. - UPI for Foreign Travelers

NPCI has extended UPI services to foreign visitors in India, allowing them to use UPI for payments via supported international accounts and wallets.

Benefits of BHIM UPI 3.0

- Enhanced Financial Access – Linking overdraft accounts ensures users can make payments even when their savings account balance is low.

- Improved Transaction Transparency – The invoice feature helps users verify transaction details before authorizing payments.

- Better Merchant Support – QR code-based payments make it easier for small businesses to accept digital payments.

- Simplified Large Payments – The one-time mandate feature is useful for high-value transactions that require scheduled payments.

- Foreign Traveler Support – Tourists and international visitors can make cashless payments, boosting digital adoption in India.

How BHIM-UPI Transforms Digital Payments

With these new features, BHIM-UPI 3.0 makes digital payments more accessible, transparent, and seamless. The inclusion of overdraft linking and pre-authorized transactions adds flexibility, while merchant-friendly QR codes further drive cashless adoption. The ability to support foreign travelers also makes UPI a more globally accepted payment method.

The introduction of BHIM-UPI 3.0 marks a significant step in India’s digital payment evolution. Whether you’re a consumer, a business owner, or a traveler, these enhancements provide more security, ease of use, and financial flexibility. As UPI continues to evolve, it remains a cornerstone of India’s cashless economy.

For more updates on digital payments and banking trends, stay tuned to Banking Insights!