Are you looking for a flexible and rewarding career in the financial sector? If yes, becoming an LIC agent could be your gateway to financial independence and a stable future. The Life Insurance Corporation of India (LIC), the largest and most trusted insurance provider in India, offers a golden opportunity for those who want to earn well, help others, and grow professionally.

In this blog post, we’ll walk you through everything you need to know about how to become an LIC agent in 2025—including eligibility, the step-by-step process, benefits, income potential, and tips to succeed.

Who is an LIC Agent?

An LIC agent is a licensed professional responsible for selling LIC’s life insurance products while providing excellent service to policyholders. These agents serve as a bridge between LIC and customers, ensuring that individuals select the right insurance plans based on their financial goals.

Eligibility Criteria to Become an LIC Agent

Before applying, it’s important to ensure that you meet the basic eligibility requirements. Here’s a quick overview:

| Criteria | Details |

|---|---|

| Minimum Age | 18 years |

| Education | Passed at least 10th standard (Matriculation) |

| Nationality | Indian citizen |

| Other Qualities | Strong communication skills, persuasive personality, and a basic understanding of financial products |

Tip: Although a 10th pass is the minimum, higher education often helps in building better rapport with clients.

Step-by-Step Process to Become an LIC Agent in 2025

Step 1: Visit the Nearest LIC Branch

To begin, visit your local LIC office and meet the Development Officer. This person will be your mentor and guide throughout the onboarding process.

Step 2: Attend the Preliminary Interview

Next, the Development Officer will conduct a basic interview. During this, your communication skills and motivation for the role are evaluated. If you pass, you’ll be recommended for the mandatory training.

Step 3: Undergo Mandatory Training

Following the interview, you will attend a 25-hour training program. This can be done either online or offline, depending on your location. The training includes:

- Basics of insurance and risk management

- Detailed knowledge of LIC products

- Ethical sales practices

- Regulatory guidelines and customer handling techniques

Note: Attending the full training is mandatory for appearing in the next step.

Step 4: Appear for IRDAI IC38 Exam

After completing training, you must appear for the IRDAI IC38 exam—conducted by the Insurance Regulatory and Development Authority of India (IRDAI). This is an online exam consisting of multiple-choice questions.

- Duration: 1 hour

- Total Questions: 50

- Passing Marks: 35

Study Tip: Prepare well using mock tests and IRDAI training materials to increase your chances of success.

Step 5: Receive LIC Agent License

Upon passing the exam, you’ll receive your official appointment letter and agent code from LIC. From this point forward, you are authorized to sell LIC policies and earn commissions.

LIC Agent Commission Structure (2025)

One of the major attractions of becoming an LIC agent is the commission-based earning model. You earn money for every policy you sell—and you continue earning from renewals in future years.

| Type of Policy | 1st Year Commission | Renewal Commission |

|---|---|---|

| Endowment Plans | Up to 35% | 5% to 7.5% |

| Money Back Plans | Up to 25% | 5% to 7.5% |

| Term Insurance Plans | Around 10% | 2% to 5% |

| Single Premium Policies | 2% (One-time) | None |

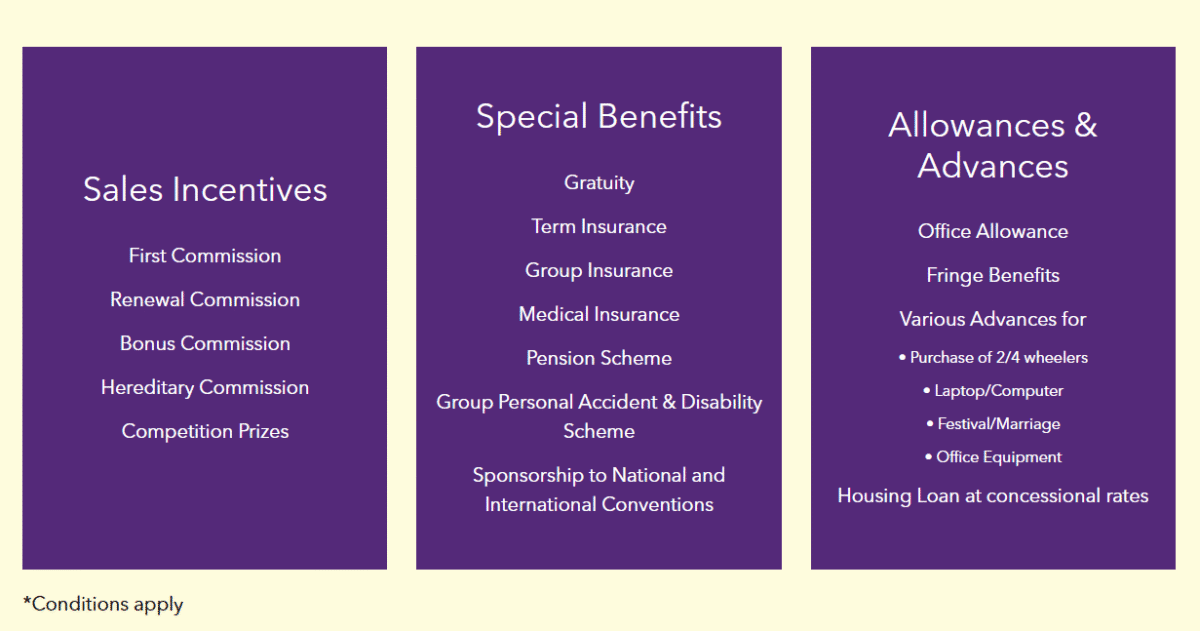

Furthermore, high-performing agents are eligible for bonuses, awards, and international incentive tours.

LIC Agent Registration Online

In some regions, LIC allows online registration for agents. Here’s how you can apply:

- Visit https://licindia.in

- Click on the “Be an Agent” section

- Fill out the form with your contact details

- A Development Officer will contact you shortly for the next steps

However, not all zones offer this feature yet. Therefore, it’s advisable to check with your nearest branch.

Documents Required

To complete your application, make sure you have the following documents:

- PAN Card

- Aadhaar Card

- 10th or 12th Marksheet (as proof of education)

- Passport-sized photographs

- Address Proof (Electricity Bill, Voter ID, etc.)

- Cancelled cheque or bank account details

Ensure that all documents are clear and up-to-date to avoid delays.

Benefits of Becoming an LIC Agent

Financial Independence

As an LIC agent, your income is performance-based. Consequently, there’s no income cap—you can earn as much as your efforts allow.

Flexible Work Schedule

Unlike traditional 9-to-5 jobs, you enjoy complete flexibility in working hours. This makes it ideal for students, homemakers, and retirees.

Performance-Based Rewards

LIC rewards consistent performers with:

- Trophies and medals

- Recognition at national and international forums

- Foreign tours and bonus commissions

Social Impact

As an agent, you play a crucial role in helping families secure their financial future. In other words, your job also contributes to society.

Tips to Succeed as an LIC Agent

- Focus on Relationship Building – Trust is key in insurance sales

- Master LIC Products – The better you understand them, the better you’ll sell

- Leverage Digital Platforms – Use WhatsApp, Facebook, and LinkedIn for leads

- Maintain Consistent Follow-Ups – Don’t let leads go cold

- Continue Learning – Attend LIC workshops and training sessions regularly

In addition, consider enrolling in financial literacy courses to boost your advisory skills.

Frequently Asked Questions (FAQs)

You must have passed at least the 10th standard (matriculation) and be at least 18 years old to become an LIC agent.

The LIC agent training program is 25 hours long and can be completed either online or offline, depending on the branch.

The IC38 exam is a mandatory licensing test conducted by IRDAI. It ensures you understand the basics of insurance, ethics, and LIC products before selling policies.

Yes, a nominal registration and IC38 exam fee—usually between ₹150 and ₹200—is required during the onboarding process.

Yes, many agents work part-time. The LIC agency model is flexible and ideal for working professionals, homemakers, and retirees looking to earn extra income.

LIC agents earn commissions on every policy they sell. They also receive renewal commissions on existing policies, along with performance-based bonuses and incentives.

Yes, you can fill out the interest form on LIC’s official website under the “Be an Agent” section. A Development Officer will contact you to take the process forward.

Final Thoughts

To sum up, becoming an LIC agent in 2025 is an excellent career choice—especially for those looking for a low-investment, high-reward opportunity. Not only does it offer financial stability, but it also allows you to make a real difference in people’s lives.

Whether you are a student, a homemaker, or someone looking for a side income, LIC provides the platform to grow, learn, and earn—all at your own pace.

Ready to get started? Visit your nearest LIC office or apply online today!