If you’re an LIC agent with big dreams, then qualifying for MDRT (Million Dollar Round Table) could be your ultimate career goal. Not only does LIC MDRT symbolize professional success, but it also reflects a commitment to ethics, service, and personal excellence.

In this blog, we’ll walk you through everything—from the meaning of LIC MDRT to practical tips for qualifying in 2025. So, let’s get started.

What is LIC MDRT?

Founded in 1927, the Million Dollar Round Table (MDRT) is a globally recognized, independent association of the world’s top-performing life insurance and financial services professionals. With members from over 85 nations and territories and 700+ companies, MDRT represents the pinnacle of excellence in the industry.

MDRT members are known for:

- Exceptional professional knowledge

- Strict adherence to ethical standards

- Outstanding client service

Membership in MDRT is considered a mark of prestige and is internationally acknowledged as the gold standard in life insurance and financial planning.

For LIC agents, qualifying for MDRT indicates that they belong to the top 1% in their field, both in terms of sales and customer service.

Furthermore, the MDRT designation enhances your credibility, builds client trust, and opens doors to international opportunities.

The Legacy and Global Reach of LIC MDRT

Established in 1927 in the United States, MDRT has grown exponentially over the years. Today, it includes more than 65,000 members from over 85 countries, including a strong representation from India.

As a result, MDRT is not just a designation—it is a global movement of ethical, committed, and high-performing professionals.

Why LIC Agents Should Aim for LIC MDRT

For LIC agents, earning the MDRT title offers a multitude of advantages. First and foremost, it significantly boosts professional reputation. Clients are more likely to trust an MDRT agent, knowing that they adhere to international service and ethical standards.

Additionally, MDRT-qualified agents often see faster career progression, better incentives, and increased client referrals. Therefore, aiming for MDRT is not just aspirational—it’s strategic.

What is the Salary of LIC MDRT?

MDRT is not a salaried position; it is a prestigious international membership awarded to top-performing life insurance and financial professionals. However, MDRT members—especially LIC agents—tend to earn significantly higher income, often in the range of ₹10 lakh to ₹1 crore+ annually, depending on sales performance and client base. MDRT status increases credibility, client trust, and high-value sales opportunities, which can dramatically boost income.

LIC MDRT Qualification Criteria (2025)

To qualify for MDRT in 2026, LIC agents must meet at least one of the following criteria during the 2025 calendar year:

A. First-Year Commission (FYC)

- Minimum: ₹9,41,000

B. Annual Premium Income (API)

- Minimum: ₹37,62,000

C. Number of Lives Insured

- Minimum: 65 individual policies

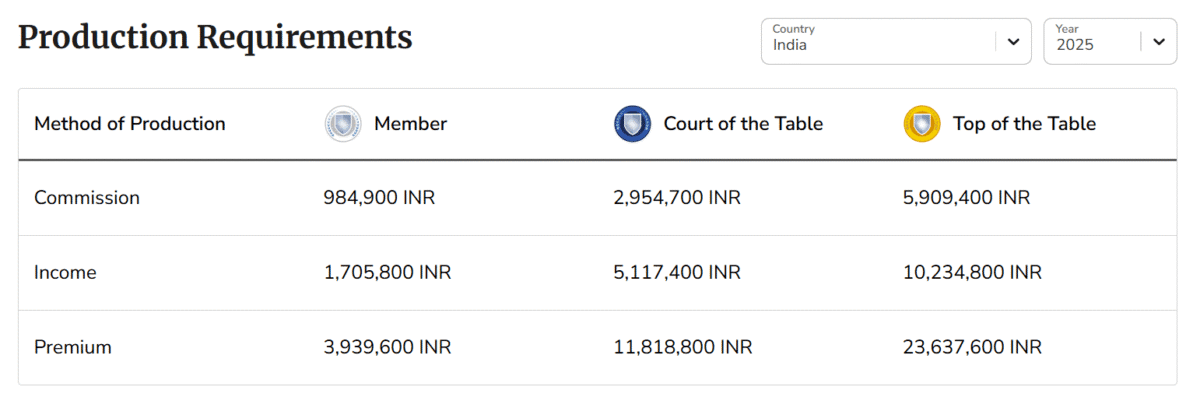

To qualify for MDRT (Million Dollar Round Table) membership in 2025, LIC agents in India must meet the latest eligibility criteria based on their 2024 production. Agents can qualify through any one of the three MDRT methods—by earning a minimum of ₹9,84,895 in first-year commission, ₹39,39,597 in paid premium, or ₹17,05,788 in annual income from insurance and financial product sales. As per MDRT India rules, at least 50% of the production must come from risk-protection products such as life insurance, critical illness, and term plans.

Please keep in mind: These numbers may slightly vary depending on the annual USD-INR conversion rate released by MDRT.

Consequently, agents are advised to verify updated figures on the official MDRT website before planning.

LIC MDRT Membership Tiers

Interestingly, MDRT offers three tiers of recognition based on performance levels:

| Tier | Qualification | Description |

|---|---|---|

| MDRT | 1x target | Entry-level recognition |

| Court of the Table (COT) | 3x target | Advanced level |

| Top of the Table (TOT) | 6x target | Elite status |

Each level not only reflects your performance but also gives you access to deeper learning and networking privileges. Therefore, the higher you aim, the greater the benefits.

How to Apply for MDRT Membership

Here’s how LIC agents can apply for MDRT:

Step 1: Visit www.mdrt.org

Select India as your country and choose your qualification method—FYC, API, or policies.

Step 2: Review Eligibility Criteria

Confirm whether you meet the income or policy thresholds.

Step 3: Collect Required Documents

Include:

- LIC-issued commission certificate

- Policy issuance details

- KYC documents like PAN, Aadhaar

Step 4: Submit the Online Application

Complete the form and upload all necessary files.

Step 5: Pay the Membership Fee

The annual fee is around $550, payable online.

Step 6: Await Approval

Once approved, you’ll receive access to MDRT’s member portal, events, and learning materials.

MDRT 2025 Membership Dues

To maintain or acquire MDRT membership in 2025, agents must pay the following fees depending on their qualification level:

| Membership Level | Total Dues (USD) | Details |

|---|---|---|

| MDRT Member | $600 | Standard membership fee |

| Court of the Table (COT) | $650 | Includes $600 MDRT fee + $50 COT fee |

| Top of the Table (TOT) | $1,150 | Includes $600 MDRT fee + $550 TOT fee (TOT fee includes COT fee) |

| Life Member (Reduced) | $200 | Available if: Age 65 by Dec 31, 2024, with 25 years of membership or 20 years with production |

Key Benefits of LIC MDRT

MDRT brings several tangible and intangible advantages:

Global Recognition

You become part of an elite global network of financial professionals.

Enhanced Credibility

MDRT boosts client confidence and helps in building long-term relationships.

Learning Opportunities

Members get access to international conferences, webinars, and mentoring.

Networking Potential

You interact with thousands of top minds from different countries and companies.

Motivation and Status

Recognition from MDRT enhances personal satisfaction and motivates you to aim higher.

Clearly, the benefits go far beyond monetary rewards.

LIC’s Support for MDRT Aspirants

Fortunately, LIC actively supports agents in their MDRT journey. Some of the initiatives include:

- Training sessions and workshops

- Dedicated support from Development Officers

- Access to digital sales tools and CRM systems

- Annual recognition ceremonies

- Zonal incentives and travel opportunities

Thus, agents don’t walk the MDRT path alone—LIC ensures they are guided at every step.

Practical Tips to Qualify for LIC MDRT

To increase your chances of qualifying, consider these proven strategies:

1. Set SMART Goals

Break your annual target into weekly and monthly goals. This allows for continuous tracking.

2. Sell High-Premium Products

Promote LIC plans like Jeevan Umang, Jeevan Labh, or Tech Term, which offer higher commissions.

3. Focus on Quality Leads

Don’t just chase numbers; focus on prospects with strong financial profiles.

4. Use Digital Tools

Leverage WhatsApp, email, and video calls to maintain client engagement.

5. Build Referral Networks

Ask satisfied customers to refer family and friends. This tactic often leads to quicker closures.

By implementing these steps, you’ll be closer to reaching MDRT status within a year.

Real Stories of LIC MDRT Achievers

Anjali Deshmukh, Mumbai

Anjali qualified for MDRT in just her second year by targeting retired professionals and hosting community seminars. She says consistency was the key.

Rajesh Malhotra, Delhi

Rajesh achieved Court of the Table by focusing on NRI clients. He credits LIC’s digital platforms for making policy presentations more effective.

Their journeys prove that with dedication, MDRT is within reach for every LIC agent.

Final Words

To sum up, MDRT is more than a title—it’s a mark of dedication, professionalism, and global recognition. As an LIC agent, qualifying for MDRT can redefine your career, open up new networks, and increase your earnings.

While the road to MDRT may seem challenging, the journey is well worth it. With the right mindset, tools, and support from LIC, you too can join this elite club.

So, why wait? Set your goals today, stay consistent, and take the first step toward becoming an MDRT-qualified LIC agent in 2025!