The IPO season is heating up again. On July 3, Cryogenic OGS Ltd launched its initial public offering. This SME-focused IPO is open for subscription until July 7.

Retail and institutional investors are showing strong interest. And for good reason. Cryogenic OGS is a Gujarat-based company with deep roots in industrial engineering. It serves key sectors like oil, gas, and chemicals. Therefore, Cryogenic OGS IPO has become a hot topic among market watchers.

In this article, you’ll find everything you need to know. We’ll cover the price band, IPO size, GMP, business details, and subscription breakdown.

What Does Cryogenic OGS Do?

Cryogenic OGS Ltd was founded in 1997. It is based in Vadodara, Gujarat. The company specializes in building fluid engineering systems. These systems include:

- Gas and fluid control

- Dosing units

- Measurement instruments

- Filtration technology

The company provides turnkey projects. That means it handles everything from design to delivery. As a result, major players in oil, gas, and chemical industries rely on it.

Moreover, its systems support critical operations. Therefore, clients treat Cryogenic OGS as a trusted partner.

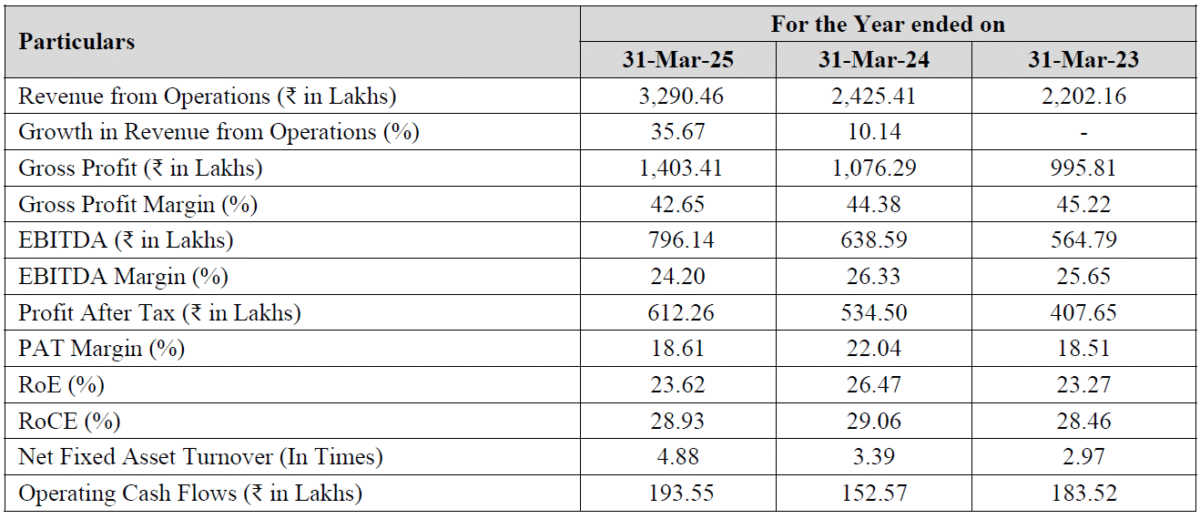

Company Growth and Revenue

Let’s look at the numbers. They show steady growth and profitability.

In FY24, the company reported:

- Revenue: ₹25.67 crore

- Net Profit: ₹5.35 crore

In FY25, it expects:

- Revenue: ₹33.8 crore

- Net Profit: ₹6.12 crore

So, revenue grew by nearly 32%. Profit increased by about 14%. Consequently, the company appears to be scaling effectively.

Moreover, its margins remain healthy. That reflects operational efficiency and disciplined cost management.

IPO Timeline: Important Dates

Here is the full schedule:

| Event | Date |

|---|---|

| IPO Opens | July 3, 2025 |

| IPO Closes | July 7, 2025 |

| Allotment Finalization | July 8, 2025 |

| Refunds Initiated | July 9, 2025 |

| Shares Credited to Demat | July 9, 2025 |

| Listing Date | July 10, 2025 |

The process is quick and well-structured. Therefore, investors won’t have to wait long for listing.

Issue Size and Structure

This IPO involves a 100% fresh issue. In other words, no existing shareholders are offloading their stakes. All proceeds go directly to the company.

- Total Issue Size: ₹17.77 crore

- Shares Offered: 37.8 lakh equity shares

- Face Value: ₹10 per share

Hence, the company will use the capital for internal growth.

Price Band and Minimum Investment

The price range is fairly affordable for institutional investors:

- Lower Price: ₹44

- Upper Price: ₹47

Retail investors must apply for a lot of 3,000 shares.

- Minimum Investment (₹44): ₹1,32,000

- Maximum for Retail: One lot

- Minimum for HNI: Three lots = ₹4.23 lakh

As a result, the IPO remains out of reach for many small investors. However, serious investors may find the price justified.

Grey Market Premium (GMP) Trends

As of July 3, the GMP is around ₹20 per share. That’s a strong indicator of investor sentiment.

- Upper Band Price: ₹47

- Expected Listing Price: ₹67

- Implied Listing Gain: ~42.5%

Therefore, a premium listing is likely. But remember, GMP is an informal indicator. Use it for reference, not decision-making.

Investor Allocation Breakdown

The IPO shares are divided across investor categories:

| Category | Allocation |

|---|---|

| QIBs | 47.38% |

| HNIs | 14.29% |

| Retail | 33.33% |

Thus, retail investors get a fair share. However, institutions will likely dominate the bidding due to the high ticket size.

Purpose of the IPO

The company will use the raised funds for:

- Working Capital

- General Corporate Expenses

That’s it. No debt repayment or acquisitions. Therefore, the focus is purely on operations and business stability.

Promoters and Key Management

The business is led by:

- Mr. Harish B. Patel

- Mr. Kirit B. Patel

They bring decades of experience in the engineering field. Moreover, they have steered the company through multiple industrial cycles. As a result, investor confidence remains high.

Lead Manager and Registrar of Cryogenic OGS IPO

- Book Runner: Beeline Capital Advisors

- Registrar: MUFG Intime India Pvt Ltd

- Market Maker: Spread X Securities Pvt Ltd

These firms are experienced in SME IPOs. Therefore, investors can expect a smooth subscription process.

Industry Trends and Demand

The company serves oil, gas, chemical, and energy sectors. These industries are growing. Moreover, India’s infrastructure boom is adding momentum.

Consequently, companies like Cryogenic OGS benefit. Industrial demand boosts order books. Also, the clean energy push opens new markets.

Therefore, the future looks promising for companies in this space.

Strengths That Drive Interest

Several factors make this IPO attractive:

1. Proven Track Record

Cryogenic OGS has operated for over 25 years. That means reliability and experience.

2. Profitability

The company delivers consistent profits. As a result, it’s not a risky startup.

3. Sector Demand

Oil and gas are core to India’s economy. Moreover, industrial expansion drives continuous demand for fluid systems.

4. Fresh Issue Only

All IPO proceeds will go into the business. That’s a positive for long-term growth.

5. High GMP

Investors expect strong listing gains. Consequently, interest is high even before the IPO closes.

Risks You Must Consider

No investment is risk-free. Let’s discuss the possible downsides.

1. SME Listing Risk

This is a BSE SME IPO. These stocks trade with low volume. Therefore, price swings can be sharp.

2. Sector Exposure

The business relies heavily on oil and gas. Any slump in that sector will hit revenues.

3. High Entry Barrier

₹1.3 lakh per lot limits retail participation. As a result, many investors will be excluded.

4. Competition

The company operates in a niche. However, local and international players can challenge its market share.

Should You Subscribe Cryogenic OGS IPO?

Let’s weigh both sides.

Why You Should Apply:

- Strong financials

- Clean structure (100% fresh issue)

- Good GMP

- Established company

- Industry demand is rising

Why You Might Skip:

- High minimum investment

- SME platform volatility

- Sector-specific risks

If you’re a long-term investor, this IPO has potential. However, short-term traders should be cautious. Enter only if you understand SME risks.

How to Apply for Cryogenic OGS IPO

Follow these steps:

- Log in to your online banking or broker account

- Go to the IPO section

- Choose “Cryogenic OGS Ltd IPO”

- Enter lot size and bid price

- Confirm and submit

Make sure your account has enough funds. Also, track allotment status after July 8.

Listing Day Strategy

Listing is set for July 10. If GMP stays strong, the stock may debut with a 40%+ gain.

Therefore, short-term investors may book profit. Others can hold if they believe in the company’s growth.

Either way, could you keep an eye on post-listing volumes? SME stocks often move sharply in the early days.

Final Thoughts

Cryogenic OGS IPO offers a unique opportunity. The company is experienced, profitable, and growing. Moreover, the GMP signals strong demand.

On the flip side, the high investment and SME risks may deter casual investors.

Therefore, assess your risk tolerance. If you’re confident in the company’s story, go ahead and subscribe.

Frequently Asked Questions – Cryogenic OGS IPO

The IPO opens on July 3, 2025, and closes on July 7, 2025.

The price band is set between ₹44 and ₹47 per share.

Investors must apply for a minimum of 3,000 shares, costing between ₹1.32 lakh and ₹1.41 lakh.

As of July 3, the GMP is around ₹20 per share, indicating potential for a strong listing.

The shares will be listed on the BSE SME exchange on July 10, 2025.

Beeline Capital Advisors is the lead manager, and MUFG Intime India Pvt Ltd is the registrar.

The funds will be used for working capital and general corporate purposes.

The IPO shows strong financials and sector demand. However, as it is listed on the SME platform, it carries higher risk and requires careful consideration.