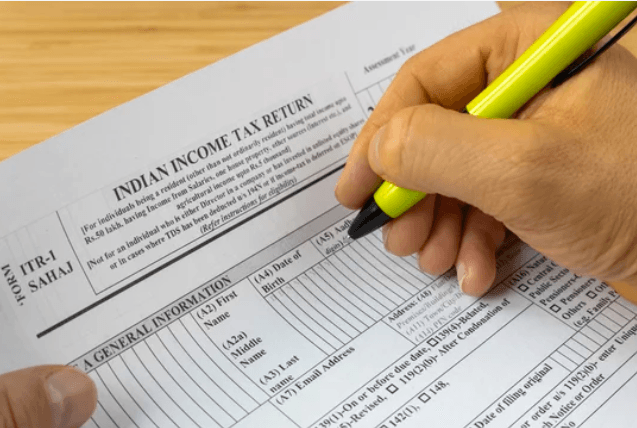

Filing income tax returns is mandatory for individuals whose income exceeds the basic exemption limit. For senior citizens and super senior citizens, the Indian Income Tax Department provides special exemptions, simplified return forms, and paper filing options. If you’re 60 or older, this guide will help you choose the right ITR form for AY 2025–26, based on your income type and financial profile.

Who is Considered a Senior or Super Senior Citizen?

As per the Income Tax Act:

- Senior Citizen: An individual who is 60 years or older but less than 80 years as on 31st March 2025.

- Super Senior Citizen: An individual who is 80 years or older as on the same date.

Your age affects your exemption limit, eligibility for paper filing, and income tax return filing obligations.

Income Tax Slab for Senior Citizens (FY 2024–25)

Under the Old Tax Regime:

| Age Group | Basic Exemption Limit |

|---|---|

| Below 60 years | ₹2.5 lakh |

| 60 to 80 years (Senior Citizens) | ₹3 lakh |

| 80 years and above (Super Senior Citizens) | ₹5 lakh |

Under the New Tax Regime, the basic exemption limit for all is ₹3 lakh, regardless of age.

🟨 Tip: Senior citizens with income below the basic exemption limit do not need to file ITR, unless claiming a refund or carrying forward losses.

ITR Forms for Senior Citizens in AY 2025–26 – Full Breakdown

1. ITR-1 (SAHAJ) – For Pensioners and Simple Income Sources

Eligible if:

- Resident and ordinarily resident individual

- Total income ≤ ₹50 lakh

- Income from:

- Salary or pension

- One house property

- Interest income

- Agricultural income ≤ ₹5,000

Not eligible if:

- Director in a company

- Holds unlisted shares

- Has foreign assets or income

- Earns capital gains

🟢 Perfect for retired employees, government pensioners, and those with a basic investment income.

📄 Super senior citizens (80+) can file ITR-1 in paper mode.

2. ITR-2 – For Those with Capital Gains or Multiple Properties

Use ITR-2 if you:

- Have income from more than one house property

- Earn long-term or short-term capital gains

- Receive foreign income or own foreign assets

- Have agricultural income > ₹5,000

- Do not have income from business or profession

🔵 Suitable for senior citizens with:

- Investments in mutual funds, shares, or property

- NRIs returning to India with foreign holdings

- Multiple rental income sources

3. ITR-3 – For Business or Professional Income

Applicable when:

- You are running a business or profession

- Have income from proprietary business

- You’re a consultant, doctor, lawyer, etc.

🔶 Also includes:

- Presumptive income under 44ADA (professional)

- Commission or brokerage income

- Income as a partner in a firm

Not suitable for those with only salary/pension or capital gains.

4. ITR-4 (SUGAM) – For Presumptive Income up to ₹50 Lakh

Eligibility:

- Resident individuals, HUFs, and firms (non-LLPs)

- Total income ≤ ₹50 lakh

- Presumptive income under:

- Section 44AD (small business)

- Section 44ADA (professionals)

- Section 44AE (transport business)

Sources Allowed:

- Salary or pension

- One house property

- Other sources (interest, dividend)

- Agricultural income up to ₹5,000

🟥 Not allowed if:

- Director in a company

- Foreign income or assets

- Holds unlisted equity shares

📄 Paper filing available for super senior citizens.

Quick Summary Table

| ITR Form | Ideal For | Income Limit | Capital Gains | Paper Filing Allowed |

|---|---|---|---|---|

| ITR-1 | Pensioners, single house property | Up to ₹50L | ❌ | ✅ (80+ yrs) |

| ITR-2 | With capital gains, multiple properties | No Limit | ✅ | ❌ |

| ITR-3 | Business or professional income | No Limit | ✅ | ❌ |

| ITR-4 | Presumptive income (small biz) | Up to ₹50L | ❌ | ✅ (80+ yrs) |

📃 When Can Senior Citizens Use Paper-Based ITR Filing?

Only super senior citizens (80+ years) can use manual (paper) filing of ITR-1 or ITR-4 if:

- Their income doesn’t include business/profession income

- They are filing themselves (not through e-intermediaries)

📌 For others, e-filing is mandatory under the law.

Key Benefits for Senior Citizens While Filing ITR

- Advance Tax Exemption:

- Senior citizens without business income are exempt from paying advance tax.

- Pay self-assessment tax at the time of filing.

- Standard Deduction:

- ₹50,000 standard deduction on salary/pension income.

- Higher Interest Exemption:

- Under Section 80TTB, up to ₹50,000 interest on deposits with banks, post offices is exempt (only for senior citizens).

- No TDS if Form 15H Submitted:

- If total income is below taxable limit, senior citizens can avoid TDS by submitting Form 15H to banks.

- Rebate under Section 87A:

- Full tax rebate up to ₹12,500 for income up to ₹5 lakh, even for senior citizens.

Old vs New Tax Regime – Which Should Senior Citizens Choose?

| Criteria | Old Regime | New Regime |

|---|---|---|

| Basic Exemption | ₹3L (Sr), ₹5L (Super Sr) | ₹3L for all |

| Deductions (80C, 80TTB, 80D) | Allowed | Not allowed |

| Slab Rates | Higher | Lower |

🟩 Choose the Old Regime if you:

- Have significant deductions (80C, 80D, etc.)

- Earn interest income and claim 80TTB

- Want to benefit from higher exemption limits

🟥 Choose New Regime for:

- Simplicity

- No investment-linked deductions

- Consistent flat rates

🛠️ Use a tax calculator to compare both regimes before filing.

Due Date for ITR Filing – AY 2025–26

- Without audit: 31st July 2025

- With audit: 31st October 2025

📣 Filing late can lead to penalties under Section 234F (up to ₹5,000)

Final Checklist for Senior Citizens Before Filing ITR

- Choose the correct ITR form based on your income

- Reconcile Form 26AS, AIS, and TIS with your documents

- Use the correct tax regime (Old or New)

- Submit Form 15H (if applicable) to avoid TDS

- Pre-validate your bank account for refund

- Check if you’re eligible for paper filing (80+ years)

Tools for Senior Citizens to File ITR Easily

- Income Tax e-filing portal: https://www.incometax.gov.in

- Aaykar Setu app (Android/iOS)

- ClearTax, TaxBuddy, Quicko (for assisted filing)

Final Words

Senior citizens deserve a smooth and stress-free tax filing experience. Whether you are a pensioner, investor, or part-time professional, choosing the correct ITR form for AY 2025–26 ensures compliance, faster refunds, and peace of mind.

Anyone who is 60 years or older but less than 80 years as of 31st March 2025 is considered a senior citizen. Those aged 80 years or above are classified as super senior citizens.

Most pensioners can file ITR-1 (SAHAJ) if their total income is up to ₹50 lakh and they have income from pension, one house property, and interest.

Yes, only super senior citizens (80+ years) are allowed to file ITR-1 or ITR-4 manually without e-filing, provided they are filing their own return and not via an intermediary.

The due date for filing ITR (non-audit cases) is 31st July 2025.

No. Senior citizens who do not have any business or professional income are exempt from paying advance tax. They can pay self-assessment tax before filing.

The old regime offers higher exemption limits, deductions under 80C, 80TTB, and 80D. The new regime has lower tax rates but fewer deductions. Compare both using a tax calculator.

Don’t wait till the last minute—file early and stay relaxed!